2026 Australian Automotive Forecast

While 2025 set a record for new vehicle sales, it was a buyer’s environment as the handbrake on vehicle supply was released and market competition from emerging players increased. This increased the prevalence of discounts, which in turn placed pressure on dealer margins.

It is worth pointing out that a sales decline in 2025 over a record-setting 2024 was widely forecast given reduced backorders post the pandemic-era shortages, however this did not materialise. It is hard to argue that national sales companies and dealers had to sweat a little harder to hit their targets, though.

There are few signs of 2026 being different to any great degree. Significant population growth post-COVID as per the ABS should broaden the potential buyer pool and keep sales ticking over, but we would expect the market to be relatively level in CY26. This was reflected in the January 2026 data.

News in January 2026 of an interest rate rise, with more forecast on the back of stubborn inflation data, will create headwinds for mortgage holders and thereby may cause younger-to-middle-aged buyers in particular to put off renewing their vehicle.

Expect more competition in the fleet market (business, government and rental) particularly as the rising Chinese companies seek to broaden their footprints. While small in volume, rental fleet sales exploded 47% YoY in January 2026, a sign perhaps of excess 2025-plate supply.

It seems realistic to forecast 1.23 to 1.24 million sales.

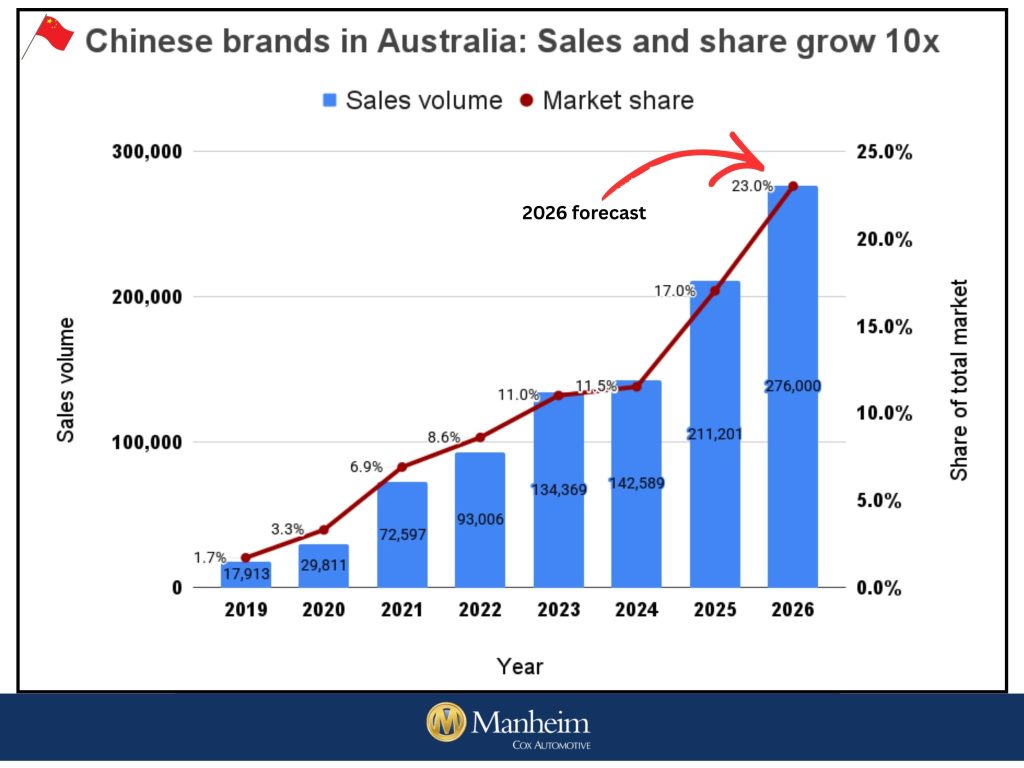

Chinese brands will continue to conquer share – for now

Chinese brands took just under 18% market share across the Australian light vehicle market (car, SUV and light commercial) in 2025 and accounted for more than 210,000 sales. This share was up from 11.5% share in 2024 and is more than 10-times greater than the 1.7% share Chinese brands held in 2019.

During the COVID period the Chinese brands had stronger levels of vehicle supply and were able to gain traction when competitors had shortages. They were also able to recruit excellent franchise dealer partners and experienced local managers to oversee their growth.

At the end of 2024 there were 10 Chinese brand names in the market selling around 30 models, while by the end of 2025 both metrics had more than doubled. By the end of 2026 there will be at least 90 different Chinese-branded car models or nameplates, a tripling in choice over two years.

Australia has long been a key export destination for players such as SAIC Motor (MG and LDV), BYD, Chery, Great Wall Motor, Geely and myriad others. As a full-import market with few trade barriers and a discerning public, it’s an ideal ‘learning’ market with low consequences of failure given its small size.

Chinese brands therefore take Australia quite seriously, for example BYD’s founder Wang Chuanfu is a semi-regular visitor to these shores. This trend shows little sign of slowing. In January Chinese OEMs captured a record 23% market share led by BYD (5.7%) and GWM (5.2%).

Today there are 22 Chinese brand names made by 12 different OEMs on sale, more than a quarter of all brands in-market. There are as many as 16 more brand names set to come by 2027, many having filed government permits and even appointed staff. See graphic attached for the breakdown.

This intense competition, the lack of growth at home given market saturation, and the fact that Chinese brands are rolling out products across basically every segment means they will continue to conquest from other players — and increasingly each other.

Given ongoing budget constraints and historically high used car prices, demand for these increasingly appealing vehicles among households is unlikely to wane. You can furthermore expect to see several of the Chinese OEMs turn to fleet sales that account for about half the total Australian market.

This is because most Chinese cars sold in 2025 were bought by private buyers: an 80% ratio for BYD, 75% for Chery, and 67% for GWM, for example. These big volume operators are yet to make major inroads with around half the market, but are ramping up investment and focus here via recruitment.

The big question is, what is the ceiling for the Chinese brand market share? We would expect the figure to grow to comfortably beyond 20% in 2026, perhaps even as high as 25% and nudging 300,000 sales.

In short, with product line-ups across almost every section of the market, absolutely no challenges with supply, improved factory and dealer support, there’s little reason to expect the Chinese advance will U-turn. Growth may slow in percentage terms from a higher base, but there’s still volume to be added.

Take-away: Chinese brands to take something close to 25% of the new car market in 2026.

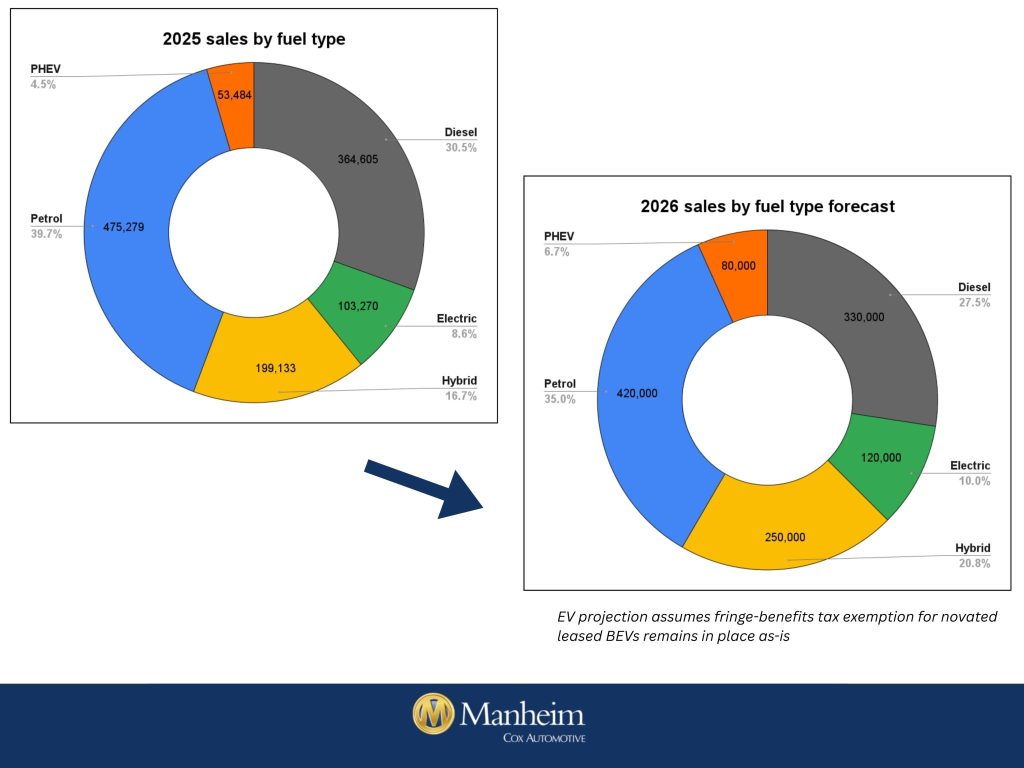

Electric car sales will increase -with one major caveat

Battery EV sales volume grew around 13% in 2025, eclipsed 100,000 units for the first time, and took out an all-time high market share of 8.6% (or about 11% of the passenger and SUV markets).

However, growth rates overall are slowing, and are not on pace to meet requirements under the New Vehicle Efficiency Standard.

BEV sales in Australia almost doubled between 2021 and 2022, and then nearly tripled between 2022 and 2023. But the increase to annual BEV sales volume in 2025 compared to 2023 was just 18.4% over 24 months. Growth yes, but not on a linear path.

The challenge here is that the availability of EV choice grew at a far more rapid rate; basically, doubling over this same two-year period (2023-25). As of the end of last year there are 120 EV models on sale from 45 different brand names, while in 2023 there were 60 models sold by 25 brands.

So, the overall market volume grew less than 20% while actual choice makes and models grew 100%.

When choice outpaces market growth, it means smaller slices of the pie for many incumbent players that dominated early in the piece. This explains for example why market leader Tesla’s share of total EV sales has eroded from 52% in 2023 to 28% last year, despite being an undoubted technology leader.

The arrival of even more BEVs in 2026 from both new players and from high profile trusted brands like Toyota and Mazda, driven by the supply-side New Vehicle Efficiency Standard fleet-average CO2 targets, will see these pressures become even greater.

Greater availability of BEVs in more segments and at keener price points, alongside steadily improving customer confidence and a tendency for BEVs to engender repeat business, should see their market share grow from 8.6% last year to 10-12% share in 2026.

A cap will remain on BEV take-up so long as the Australia love affair with large body-on-frame SUVs and utes continues, with five of the top six overall vehicles last year falling into one of these categories.

While the hugely successful BYD Shark 6 plug-in hybrid shows there is indeed demand for electrified light commercials, by and large this huge corner of the market remains diesel-dominated.

Furthermore, BEV sales are particularly vulnerable to government decisions, something we saw recently in New Zealand. Should the Federal Government revisit the fringe-benefits tax exemption for novated lease EVs, as has been reported, BEV sales volume would be swiftly impacted.

The National Automotive Leasing and Salary Packaging Association estimates around half (47%) of all BEVs sold in 2025 were sold on a tax-reducing novated lease. There is no doubt that many of these BEV buyers would have opted for a cheaper hybrid or ICE vehicle without this FBT exemption.

Hybrids of both types will grow at faster pace as a first step under NVES

Traditional Toyota-style hybrids likewise set a new sales record in 2025, and this will continue in 2026 largely to the detriment of non-hybrid petrol car sales. Closed-circuit hybrids accounted for just under 200,000 sales in 2025, up 15% YoY and equal to 22% of the overall passenger and SUV share.

On the demand side many car buyers and fleet managers see non-plug-in hybrids as the right ‘middle ground’ step to cut their fuel bills without making changes to their driving habits and routines, at a price point that appeals.

At the same time, we should see supply of hybrid vehicles improve further as factories across the world pump out more electrified offerings.

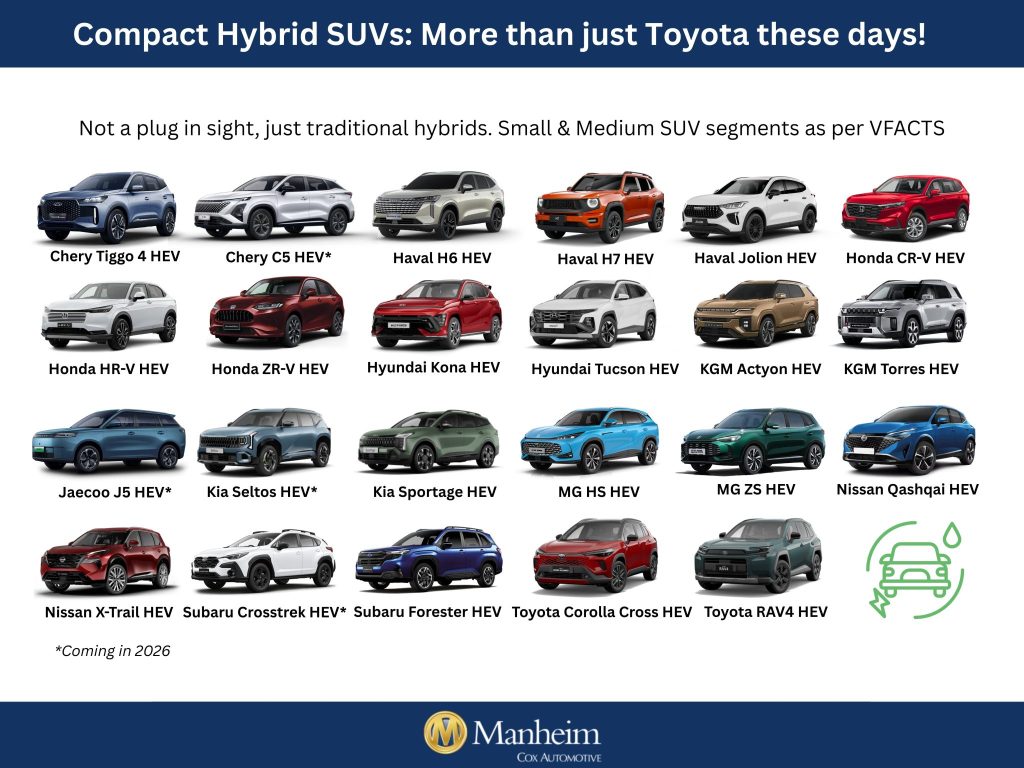

Many brands have pivoted back to electrified hybrids, having seen their BEV sales grow at a much slower rate than anticipated. We will also see more hybrid options in popular models driving not just consumer demand but also the need to reduce range-average emissions under the now-active NVES.

Consider the two mainstream Small SUV and Medium SUV markets, which alone make up 40% of the total new vehicle market. Today there are 23 different hybrid (non-plug-in) models available made by 12 different brands to choose from.

At the same time, plug-in hybrids exceeded sales projections in 2025 and grew 130% despite the end of juicy tax breaks on them over 2024, and furthermore sales are up five-fold since 2023. These vehicles will grow in uptake even further throughout 2026.

This will be driven in part by the increased push of PHEV utes like the BYD Shark 6, Ford Ranger and GWM Cannon Alpha to owner-operators and (from 2026 onwards) fleets driven by NVES, plus the ongoing mass rollout of Chinese plug-in SUV offerings from BYD, GWM, Chery and others.

Moreover, there’s the anticipated launch of PHEVs from established and high-volume brands, not least Toyota with its all-new RAV4 – the nation’s single top-selling SUV. As Toyota turns to more plug-in hybrids, it will heavily influence the overall market.

Thus, as prices come down, choice increases, and perhaps more importantly the typical PHEV pure-electric range grows from 50km to more like 100km, consumer uptake will naturally lift. Plug-in hybrids may be a bridging technology long-term, but they are far from peaking in the Australian context.

Take-away: Hybrids and PHEVs combined accounted for 21% of the market in 2025. We would expect this figure to be more like 26-30% in 2026. See the attached graphics for some breakdowns of what to expect in 2026.

Some other issues to ponder

We have passed ‘peak ute’ for the major players

Market leader Toyota already thinks its Australian arm has potentially passed ‘peak ute’, and it seems plausible that this part of the market will show only low levels of growth in 2026, if it grows at all.

This is despite the continued rollout of new models to compete in this segment, which accounts for about 1-in-5 of all new vehicle sales in Australia.

Why? It’s not so much about demand falling in a heap, but rather the sheer increase in choice leaves smaller market share for all the major players. This is why from an OEM’s perspective; it’s going to be tough to retain share.

10 years ago, the dual-cab ute market comprised 13 models from 12 brands, whereas today there are 27 models from 21 brands. At the same time market share has grown from 12.5% to 18.3%. So, in essence choice has grown 100% while the total market has grown 50%.

At the same time, expect affordability to achieve plenty of spotlight. As carmakers face NVES penalties for high-emitting vehicles skewing their range-wide average, they are likely to home in on higher-spec, higher-margin variants of their ute models rather than entry-level workhorse grades.

Carmakers will turn more to white-label finance and insurance programs

Dealers are facing revenue challenges from both new car margin compression and from the spectre of reduced recurring revenue from services — driven both by the ubiquity of low-cost capped-price servicing plans that don’t always increase with CPI, and the growth of EVs with lower maintenance costs.

One way dealers in partnership with the OEM franchisors can carve out more revenue is by expanding their role in areas such as branded and often white-labelled finance and insurance.

Carmakers that offer their own F&I sold at the dealer offer customers the promise of a simpler and easier transaction journey, a veritable one-stop shop, while at the same time they and their retailers get a greater share of a customer’s vehicle running cost budgets.

They can also hedge against resale value concerns on electric cars with guaranteed future values programs.

This is already happening, but the cadence will escalate in the pursuit of profit streams.

There is a real chance a few brands will make decisions on their future in 2026

To run a viable factory-backed national sales company (NSC) responsible for importing, distributing and maintaining vehicles, a certain amount of sales volume is generally required – super high-margin luxury players excepted.

The rollout of more brands into the Australian market will in all likelihood further erode market share for some existing participants, something we are already seeing out there.

While we won’t speculate on any brands that are at risk, there’s a generally accepted view across the industry that some players will come under greater pressure to exit the market, due to a lack of viability.

Alternatively, some may choose to take the path that Renault (as one example) did several years ago, closing their NSC and appointing an independent distributor such as Ateco, Inchcape or Jameel to sell their vehicles. This is a leaner business model from an OEM’s point-of-view.